The coronavirus outbreak has affected many industries, but the automotive industry is among the hardest hit. After carmakers stopped production and dealerships closed showrooms amid Covid-19 lockdowns, global car sales slumped worse than ever before. However, the luxury car market was generally less affected by the financial downturn caused by the coronavirus pandemic.

According to data presented by StockApps, the market capitalisation of the world’s most valuable car company, Tesla, hit over US$460bn this week, almost seven times more than Ferrari, Porsche and Aston Martin combined.

Tesla market capitalisation soared 513% since January

2020 has been a fantastic year for Tesla, despite the effects of Covid-19 on the global automotive industry. The company’s stock price surged by nearly 200% in the last three months and they’re up about 500% on the year, despite a 4.9% revenue drop in the second quarter of 2020.

One of the reasons for such a premium valuation is Tesla’s ability to convince investors that it’s much more than just an automaker, and plans to make its vehicles capable of deploying into an autonomous “robotaxi” ride-sharing service prove that.

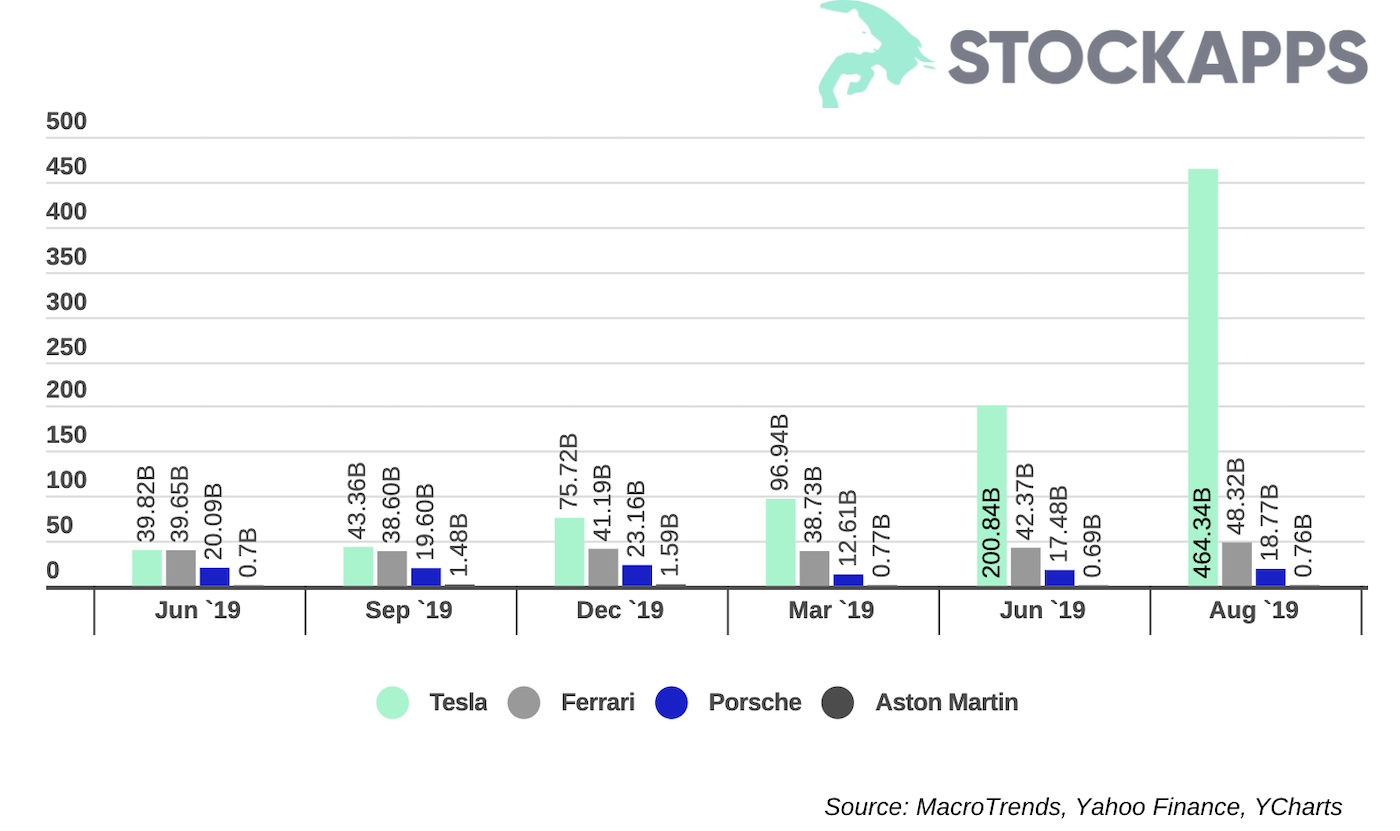

In December 2019, the market cap of the world’s most valuable car company stood at US$75.7bn, revealed the YCharts data. By the end of the first quarter of 2020, this figure rose to US$96.9bn, despite the Covid-19 crisis. Statistics show Tesla market cap surged by 107% in the next three months, reaching US$200.8bn value at the end of June. At the beginning of this week, it jumped over US$460bn, which is four-times the IBM market cap. Since the beginning of the year, the Tesla market cap has soared by 513%.

Ferrari market capitalisation rose by US$7.1 billion in 2020

The disruptions of the Covid-19 pandemic caused a substantial hit to the Italian supercar maker Ferrari, which was forced to close its factories for seven weeks. The Q2 2020 financial report revealed a 42% plunge in revenue year-on-year and halved shipment of vehicles due to both production and delivery suspensions.

The company also narrowed the range of its full-year profit guidance with the estimated revenue of more than €3.4bn, compared to previous guidance of €3.4bn to €3.6bn, and the adjusted earnings before interest, tax, depreciation and amortization of between €1.07bn and €1.12bn.

Nevertheless, the luxury carmaker has performed better than most other car manufacturers, and remains confident of a bounce-back in the second half of 2020 thanks to its strong order book.

In December 2019, the market capitalisation of Ferrari touched nearly US$41.2bn. After the Black Monday crash in March, this figure dropped to US$38.7bn. However, the second quarter of 2020 witnessed an increasing trend, with the Ferrari market cap rising to US$42.3bn in June. Statistics show the company’s market capitalisation stood at US$48.3bn at the beginning of this week – a 17% increase since January.

Porsche and Aston Martin market cap fell in 2020

While Tesla and Ferrari’s stocks performed well amid the coronavirus crisis, other leading luxury sports car manufacturers witnessed a plunge in their market capitalisation since the beginning of the year. Statistics show the combined value of shares of Porsche dropped by 19% in the last eight months, with the figure falling from US$23.1bn in January to US$18.7bn this week.

The financial results for the first half of the year revealed the German automaker’s sales decreased by 7.3% year-on-year to €12.42bn. The company recorded an operating profit of €1.2bn, while deliveries in the first six months of 2020 dropped by 12.4% globally, to under 117,000 vehicles.

Statistics show Aston Martin more than quadrupled its operating loss for the first six months of 2020 after a sharp fall in sales and revenue amid the Covid-19 pandemic. The British sports car manufacturer sold just 1,770 vehicles in the first half of the year, while total retail sales stumbled to £1.77bn – a 41% plunge year-on-year.

Moreover, the company’s market capitalisation halved in 2020, with the combined value of stocks falling from US$1.6bn in January, to US$760.2 million in August.